Whatever business we plan to start, understanding it deeply is always helpful.

Why? Because when you know the depth, you can discover new ways that others may have missed.

Think about it… Maybe you will find opportunities that competitors have not noticed yet. And those opportunities can have huge potential to generate profits.

So let’s come to the point. Crypto trading bot strategies.

Many people, when they plan to create a crypto trading bot, go with generic strategies. But here’s the problem. Generic strategies will throw you into a space filled with heavy competition.

So what should we do?

Instead of walking the same path that everyone else takes, we must look for unique ways.

And now comes the exciting part… shall we discuss how many types of automation strategies exist, why they are needed, and how they can help?

👉 Stay with me, because everything you need to learn is right here in this blog.

What are Crypto Trading Bots and How Do They Work?

Let me explain.

A crypto trading bot is basically a computer program. It buys and sells cryptocurrencies automatically based on rules or strategies.

Now you may be thinking, How does it really work?

Here’s the thing. Traders connect the bot to their exchange account. After that, the bot keeps watching the market all the time. It reacts faster than any human.

Think of this example. Suppose the Bitcoin price drops to a level fixed in the bot. The bot will buy it immediately.

Later, when the price goes up, the bot will sell it. Traders don’t need to sit in front of the screen the whole day.

And here’s another point. Bots don’t have emotions. They will not panic if the price falls. They will not lose control when the market moves higher. They simply follow the rules or learn patterns and trade efficiently.

Now, let's understand the crypto trading bot types.

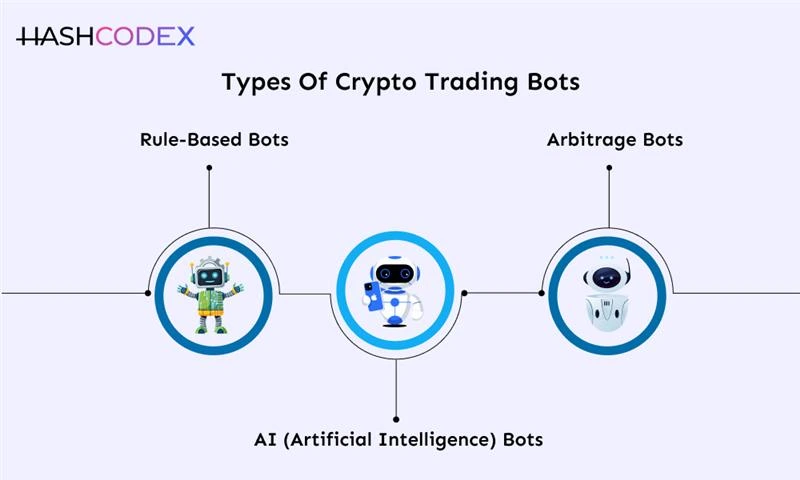

Types of Crypto Trading Bots

Rule-Based Bots

Rule-based bots follow pre-set rules. Think of them like following a recipe. You tell the bot what to do. For example: buy if the price drops 5 percent and sell if the price rises 5 percent.

This works only on predefined strategies. It is like command mode. The bot will act only when the command is given.

Based on the rules you set, the bot will buy automatically when the price hits your target. Traders do not need to check the market every hour.

👉 Pay attention. These bots are good for beginners because they are predictable and easy to manage.

AI (Artificial Intelligence) Bots

Now let’s talk about advanced technology. AI bots are smarter. They do not just follow what we say. They automatically learn from past market patterns and make predictions.

It is like having a market expert working for you 24/7.

Let me explain with an example. Suppose a coin usually rises after dropping 2 percent. The AI bot can recognize this pattern and buy automatically. Later, when the price is higher, it sells.

Why does this work? AI bots adapt to changes. They do not stick to fixed rules. This makes them useful for traders who want smarter and flexible decisions.

Arbitrage Bots

Here’s another type. Arbitrage bots.

For example, imagine Bitcoin is cheaper on Exchange A and more expensive on Exchange B. An arbitrage bot will buy from A and sell on B automatically.

Here’s why this is useful. This strategy takes advantage of price differences across exchanges. If done correctly, it can give stable profits with less risk.

Think of this example. Exchange A sells Bitcoin at $3000, and Exchange B sells at $3100. The bot buys from A and sells at B. That means you make $1000 per BTC automatically.

Best Crypto Trading Bot Strategies For Business In 2026

Mean Reversion

Mean reversion simply means that prices usually go back to their average after moving too high or too low.

Think of this like walking a dog. Sometimes the dog runs too far ahead, but the owner pulls it back. If the dog lags behind, it moves forward again.

Now imagine this. Bitcoin is usually around $100. Suddenly it jumps to $120. A mean reversion bot will sell at the high price. Later, when it drops near $80 compared to the normal average, the bot buys again.

Why does it work? Because prices often return to the average. This strategy can give steady profits if used properly.

Momentum Trading

Momentum trading is all about following the trend. If a coin is rising, the bot buys. If it is falling, the bot sells.

Think of a river or a runner. If someone is running fast, you expect them to keep running for some time.

If you had to bet on a winner, you would choose the fastest runner, not the slowest one. Same here. Suppose Bitcoin rises 3 percent continuously. The bot sees the trend and buys. Later, it sells for a profit.

Why does it work? Many coins continue their trend for some time. Momentum bots use this to make money.

Arbitrage Strategy

Here is the point. Arbitrage bots focus on price differences between exchanges. The goal is simple: buy low and sell high quickly.

Example. If Bitcoin is cheaper on one exchange, the bot buys there and sells on another exchange where the price is higher.

Arbitrage has many types.

- Cross exchange arbitrage,

- spatial arbitrage,

- triangular arbitrage,

- statistical arbitrage, and flash loan arbitrage.

👉 Before developing an arbitrage crypto trading bot, entrepreneurs must understand each of these types clearly.

MACD Trading

MACD is a trading indicator that uses lines to show market momentum. Bots buy when the MACD line crosses above the signal line and sell when it crosses below.

Think of it like this. Momentum trading bots tell you if the market is going fast or slow. But MACD is like a speedometer. It gives exact data about the movement.

Example. Bitcoin MACD crosses above the signal line. The bot buys. Later, when it crosses down, the bot sells.

Parabolic SAR Strategy

Here is the trick. Parabolic SAR predicts trend reversals. Bots use it to know when to enter or exit trades.

Example. Dots appear below the price, the bot buys. Dots appear above the price, the bot sells. Simple and useful for beginners.

Bollinger Band Strategy

Bollinger Bands are nothing but three lines on a chart. The middle line shows the average price. The upper and lower bands show volatility.

Simple logic: buy near the lower band, sell near the upper band. Lower band means price is looking low. Upper band means the price is looking costly.

Suppose Bitcoin is moving between $33,800 and $36,000. The bot buys near $33,800 when the price touches the lower band. Later, when the price climbs near $36,000 at the upper band, the bot sells.

Profit is around $2,200 per Bitcoin. But remember, in real life, fees and slippage reduce the profit.

These are some of the popular strategies. There are many more, but right now these are the ones most people are expecting and using.

How To Choose The Right Bot Strategy For A New Business?

Choosing the right strategy may look tricky, but it is not impossible.

First, ask yourself one simple question.

Do you want something easy to start with, or something advanced that predicts market trends?

If you want simple, go for strategies like rule-based bots or mean reversion. These are perfect for beginners.

If you want advanced, then AI bots or momentum trading bots are better, but they need more learning.

Next, think about risk. Some strategies are safer, while some carry more risk. For a new business, it is always better to start with low-risk strategies.

Now let’s talk about trading style.

Do traders want short-term profits or long-term growth?

Are they advanced or just starting out?

Understanding trader behaviour in the market is important. Bots can be set differently for both styles.

Finally, always test small before scaling. Let the bot trade with small amounts first. Learn from the results. Then slowly increase the size. Remember, testing and learning is the key to long-term success.

Forex Trading Bot Strategies

If you are thinking of starting a business beyond crypto, forex trading bots can also help.

Forex bots use almost the same strategies as crypto bots, but they work on currencies like USD, EUR, or INR.

Here are some common strategies:

- Trend Following: Buy or sell based on market direction. If a currency is rising, the bot buys. If it is falling, the bot sells.

- Range Trading: Buy at low prices and sell at high prices within a fixed range.

- Scalping: Make small profits many times in a single day. This is useful for traders who want quick results.

Using a bot, whether in crypto or forex, reduces manual work. Traders don’t need to watch the market all the time. Bots can help generate profits by trading automatically.

But remember one thing. Always start small and test strategies first. Learn from the results, then slowly increase.

What Common Problems Do Entrepreneurs Face With Crypto Trading Bot Strategies?

Making a crypto trading bot looks exciting. But when people start, they face some common problems.

- Unclear rules Many do not know what rules to set for the bot. If the rules are not clear or complete, the bot may act in a wrong way and make trades that do not match your plan.

- Too many features Adding too many things can confuse the bot and make it slow. When there are extra buttons, options, or codes, the bot may not run smoothly. Simple bots with fewer features usually work better.

- Not knowing market behaviour If people do not understand how crypto prices move up and down, the bot strategy becomes weak. Without knowing basic market behaviour, the bot cannot make good decisions.

- Wrong indicators Some choose indicators that do not match their plan or business model. On paper it looks fine, but in the real market it fails. Picking the right indicator is very important for success.

- Technical problems Bugs, slow servers, or poor connections can stop the bot from working properly. Even small technical issues can lead to big losses if trades are missed.

- No testing Many skip testing before using the bot. Without backtesting or live testing, even a good strategy can fail when the market changes suddenly. Testing helps to find mistakes early.

- Too much trust in automation Some think the bot will do everything and give profits always. But remember, the bot only follows the rules you give. Good rules and good design mean good results.

👉 Tip: Start with a simple plan. Test it with small trades. Improve step by step. Keep the rules clear, keep the bot light. Slowly, as you learn more, the bot will work better and give reliable results.

Final Takeaway for New Entrepreneurs

Crypto trading bots can be powerful products, but they do not create themselves.

As entrepreneurs, you and I are the ones building it, so the success of the bot fully depends on how we design it, how we test it and how we plan its place in the market.

Before creating a crypto trading bot, you must do a few things:

- First, hire a knowledgeable and creative crypto trading bot development company.

- Next, make a proper plan for what you want to create.

- Start small, try different automation models, and understand how real users behave.

With time, you will learn which strategies your bot should support, how the system should react to market changes, and what features your customers really need. This way, you can build a bot product that lasts and stands out.

Always remember: keep checking how your bot performs, collect feedback from users, and upgrade the system regularly.

Finally, treat your trading bot as a smart digital product, not just a tool. The bot executes trades, but your vision, planning, and improvements make it valuable.

This is how entrepreneurs build successful crypto bot businesses: slow, steady, and strategic.