Every business has two sides. One side is full of chances to grow. The other side has challenges you cannot ignore.

The same is true for building a crypto exchange. You can reach people across the world. You can earn big and grow your business for the long term. Sounds exciting, right?

But wait, there is another side. Competition is tough. Rules are not always clear. And yes, hacking is always a risk.

Here is the good news. These challenges are not permanent. With the right plan, smart strategies, and the right tools, you can solve them easily.

So, before you take your first step, let’s explore the real pros and cons of building a crypto exchange. We will also see how you can reduce risks and make your business profitable in 2026.

What is a Crypto Exchange?

A crypto exchange is a digital marketplace where users can buy, sell and trade cryptocurrencies and other digital assets like NFTs. It works like traditional stock exchanges, but instead of shares, it deals with cryptocurrencies.

Crypto exchange acts as an intermediary to connect buyers and sellers, and allows them to transact with fiat currency or other cryptocurrencies. It also has tools for managing digital assets, secure trading, and price tracking.

Advantages and Disadvantages of Building a Crypto Exchange

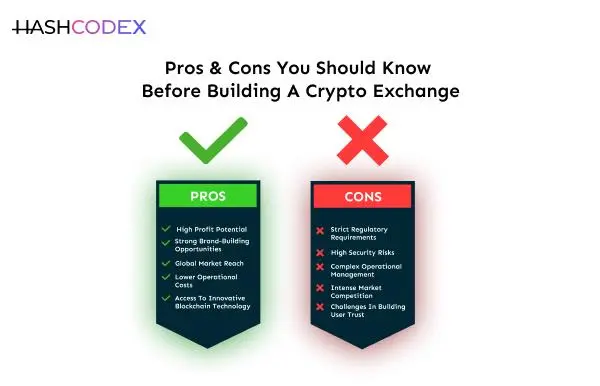

Building a crypto exchange offers more benefits, like high profits and market access, but it also comes with certain risks and challenges. The balance of pros and cons is the matter of developing a successful crypto exchange. Here are the benefits and drawbacks you should be aware of:

Pros

Profits opportunities

A cryptocurrency exchange helps you generate income through several fees, like trading, listing, deposit, and withdrawal fees. They can also earn from premium services such as margin trading and API access for trading bots.

The crypto market continues to grow with a worldwide user base. A well-built exchange can beat the competitors and lead the market.

Strong brand identity

If you’ve your own exchange, then you can control the branding, user experience, and overall platform growth. This helps you build a reputation and trust among users. You can also integrate it with some advanced features like wallets, payment gateway and other trading tools.

This improves user experience and loyalty.

Global reach

Cryptocurrency exchanges are not specific to locals. It opens up the opportunity for people around the world. No matter which location you are, you can access the large potential customer base.

Low cost

The cost of developing a crypto exchange is comparatively low when compared to other types of businesses. If you have the right skills and knowledge, you can start your own cryptocurrency exchange.

Innovative technology

New advancements like AI are changing the way businesses operate. When it comes to the crypto industry, it keeps innovating with advanced features and services to attract active users in the world.

Cons

Regulatory restriction

The regulatory frameworks for crypto exchanges are not set properly and vary according to the country you operate. Adapting to new features and rules like KYC and AML might be complicated. If you don’t meet these rules, it can lead to fines and legal actions.

Security risks

Even though it prioritizes security, hackers are targeting exchanges because of hold large amounts of funds. A single security breach can cause high financial losses and permanent damage to the reputation. So be alert and do security checks frequently.

Operational challenges

New exchanges have more risks in attracting buyers and sellers to create high liquidity. Without enough liquidity, traders are slow, and then they switch to other existing platforms. Maintaining liquidity and an easily accessible user interface to attract more traders.

Heavy competition

The crypto exchange market is always crowded and dominated by the major leaders like Coinbase and Binance. Differentiating the new platform and gaining market share is too hard. Developing something advanced, or using a white-label solution could help you take the lead soon.

Difficulty building trust

The crypto industry has a history of scams, hacks, and exchange failures (eg, FTX), so building customers’ trust and a strong reputation are the main challenges for a new platform. Develop a platform with strong security that handles high-volume transaction matters.

These are the main pros and cons of crypto exchange development, and it is important to be aware of them to make better decisions.

Cryptocurrency Exchange Types You Can Develop

Once you’ve got an idea about crypto exchanges. Let’s see their different types:

There are three main types of crypto exchanges:

Centralized Exchange (CEX)

It is handled by the single authority that acts as a trusted intermediary for transactions. Users can deposit funds, then CEX manages all orders and trades. It offers a user-friendly interface, fiat-on-ramps, and high liquidity.

For example: Coinbase and Binance.

Decentralized Exchange (DEX)

It runs on a blockchain with no intermediary or central authority. It allows users to trade peer-to-peer using their wallets. It focuses on privacy and security, and users have control of their private keys and assets.

For example: Uniswap and PancakeSwap.

Hybrid Exchange

It is the combination of both CEX and DEX platforms. It aims to provide high liquidity and user-friendliness of centralized exchange and implement some features like better security of a decentralized exchange.

For example: KuCoin and ApolloX.

Is Crypto Exchange Development Still Profitable in 2026?

Yes, crypto exchange development is still a profitable idea in 2026. The market has grown. Today, users don’t want just a place to buy and sell coins; they expect security, speed, advanced tools, a user-friendly interface, better support, and compliance.

Exchanges that deliver these things will get more revenue from various fees like trading, listing, staking, futures, token launchpad, premium features and subscriptions. Demand and competition are higher in this field.

More institutions and businesses are adopting crypto. Many new regions are launching with easier regulation and tokenized assets, which creates more trading volume. This is the best opportunity to grow and earn more.

Conclusion

Now, you know both the positive and negative sides of developing a crypto exchange. You might think, “Should you build it from scratch or use a white-label solution, or partner with an existing exchange?”

Instead of acting from excitement, just think like a strategist: Does your goal need a custom build or go with some other option? Your decision will not just decide how you start, but it will also help you win in the long term.

At Hashcodex, we’re a reputable cryptocurrency exchange development company and work with a larger number of clients from different industries. Our experienced and skilled developers understand your business needs and complete every project on time without compromising quality.

Whether you’re deciding to build it from scratch or use a white-label solution, we’re ready to help you and satisfy your demand.

Contact us right now!