If you trade crypto or plan to build an exchange, there’s one thing you must know.

What is it? 👉 Order types.

Many people may guess that a new feature has been launched.

But no, it’s the basic foundation of every crypto exchange. Without this knowledge, trading feels incomplete.

It’s like doing SEO without a technical setup.

You may get some rank, but beating websites with strong technical SEO is too hard.

Spot, margin, and futures orders are used in every exchange. These are the tools pros never skip.

Want to move one step ahead and be smarter than others?

Then you must understand every order type in detail.

Here’s the good news. We’ll explain spot, margin, and futures orders with easy examples.

By the end, you’ll know how each order works. And yes, you’ll be closer to trading like a full-stack expert.

Ready to explore? Let’s begin.

What Are Trading Order Types in Crypto?

Trading order types in a crypto exchange are different ways to place buy or sell trades on an exchange. They tell the system when to execute your trade, at what price, and under what conditions. In simple words, they give you full control over how your trade happens.

Now, let’s make it easy to understand:

- Buying at today’s price = Market Order

- Buying only within the limit we set = Limit Order

- Selling when the price goes up to your target = Take Profit Order

- Selling if the price falls too much = Stop Loss Order

Many people already know these basics. Now, let’s look at some unique order types that most traders haven’t heard of.

Spot, Margin & Futures Orders Types: What Pros Know, You Don’t

Spot, margin, and futures trading have their own order types. Some are common to all, while others are unique. Here’s the full list explained.

Spot Trading Order Types

Market Order

These types of orders help buy assets or shares at the current market price. The main focus is speed to catch the current price and make trades quickly. Based on your focus on the market price, you can’t control the price.

Limit Order

A limit order means you decide the price at which you want to buy or sell. It gives you full control over the trade.

For example, if a coin is $10 now and you place a buy order at $8, the system will only execute when the price drops to $8.

The same works for selling. If you set $12 as your limit, it will sell only when the coin reaches $12. This way, you avoid buying too high or selling too low.

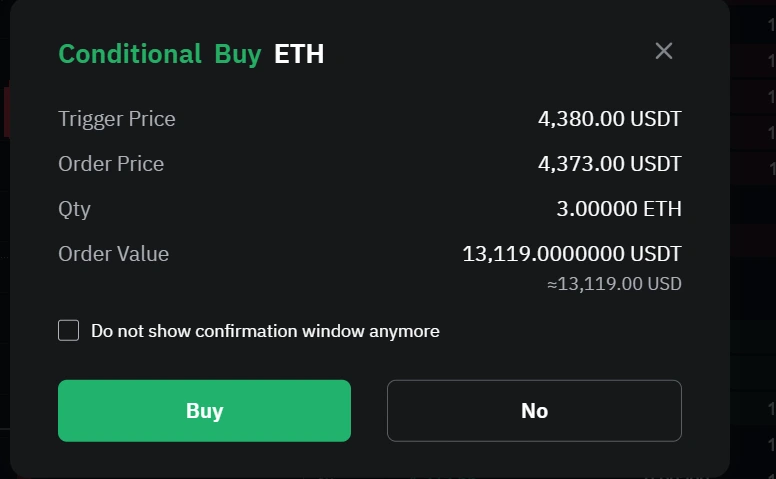

Stop Limit Order or Conditional Order

This order has two conditions: a trigger price and a limit price. Once the trigger price is reached, it turns into a limit order. This saves you from waiting too long for an exact match.

With a normal limit order, you must wait until the market touches your chosen price. But in a stop-limit order, once your stop is hit, the limit order activates quickly.

Example: A coin is trading at $100. You set the stop at $98 and the limit at $97. If the price drops to $98, your limit order at $97 is placed automatically.

Note: A limit order enters the order book instantly. A stop-limit or conditional order stays hidden until the stop price is triggered. Only then does it appear in the order book.

Take Profit / Stop Loss (TP/SL)

These orders help traders control risk. Take Profit sells automatically when your target price is reached. Stop Loss closes the trade if the price drops too much.

Example: Suppose a coin is at $10. You set Take Profit at $15. If the price touches $15, your order sells, giving you a $5 profit.

Now, imagine you buy a coin for $30. You set the Stop Loss at $28. If the price drops to $28, the order sells automatically, saving you from bigger losses.

OCO (One Cancels the Other)

OCO is a special order type. You place two orders together. One order is to take profit. The other order is to stop loss.

Here’s the smart part → when one order happens, the other gets cancelled. Simple, right?

Let me give you an example.

Imagine a coin trading at $100. You set a sell order at $120. If the price goes up, you lock in $20 profit. At the same time, you set another order at $90. If the price drops, it sells and saves you from a bigger loss.

So, only one order will run. The moment it triggers, the other one disappears.

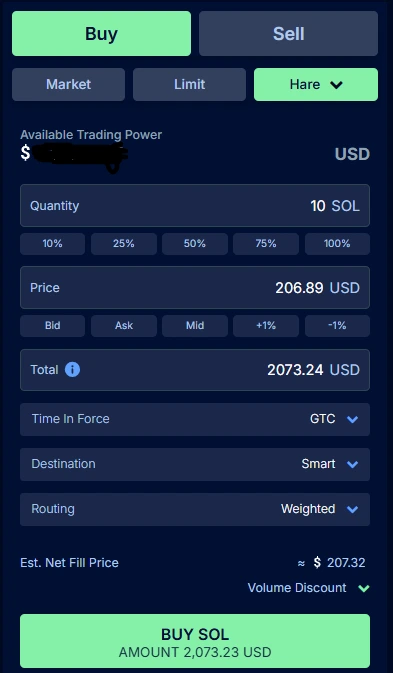

Hare Order

A Hare order is like a smart limit order. You choose the highest price you are ready to pay. The system then keeps your order in the best place of the order book. It also makes sure you don’t pay more than your set price and helps you get filled faster.

You say: “I’ll pay up to $212 for 1 SOL, but I don’t want to wait. Put me in the best position.”

Here’s what happens:

- If another person also bids $212 → Hare puts your order in front of them.

- If someone bids higher, like $213 → Hare checks if anyone is still selling at $212 and moves your order there.

- If the price drops to $211 → Hare changes your order so you can buy cheaper.

👉 Hare means your order doesn’t just wait. It keeps moving to the best spot automatically, always inside your $212 limit.

Polar Bear Order

Polar Bear order means you set a max price; it only buys or sells at the best price available. If not fully done, the rest hides in Dark Pool until the price matches.

Suppose you want to buy 500 SOL at $206.

- Right now, the best price is $206 → you get 120 SOL.

- The remaining 380 SOL hides in Dark Pool.

- After 10 minutes, the price comes back to $206 → 200 SOL more gets filled.

- Later, the price again reaches $206 → last 180 SOL gets filled.

👉 In the end, you bought all 500 SOL, but the market never saw your full 500 order at once.

If you are looking for a full spot trading crypto exchange development, we build exchanges focused only on spot trading features. Book a call with Hashcodex experts today.

Margin Trading Order Types

Margin trading uses most of the same order types as spot trading, like market, limit, take profit, stop loss, and OCO. But there is a big difference. Margin trading involves borrowing funds, which means more risk, and you also have to pay interest.

Because of this, margin trading is best handled by experienced traders who understand the risks.

Depending on the crypto exchange, margin trading may include all the same order types as spot trading. Some exchanges may also add one or two extra conditions to make trading safer or more flexible.

Entrepreneurs who want to earn more and trade with a margin can use our margin trading exchange development services. We build crypto exchanges made only for margin trading with smart algorithms.

Futures Trading Order Types

As usual, futures also have some of the same conditions as spot trading, except that futures come with more options.

Smart Order

This is a unique strategy. A smart order works like an expert trader. You don’t need to choose a market or limit manually. It automatically makes trades on your behalf and finds the best options for you.

You only need to enter the quantity of the asset you want to buy, and the system will handle the rest.

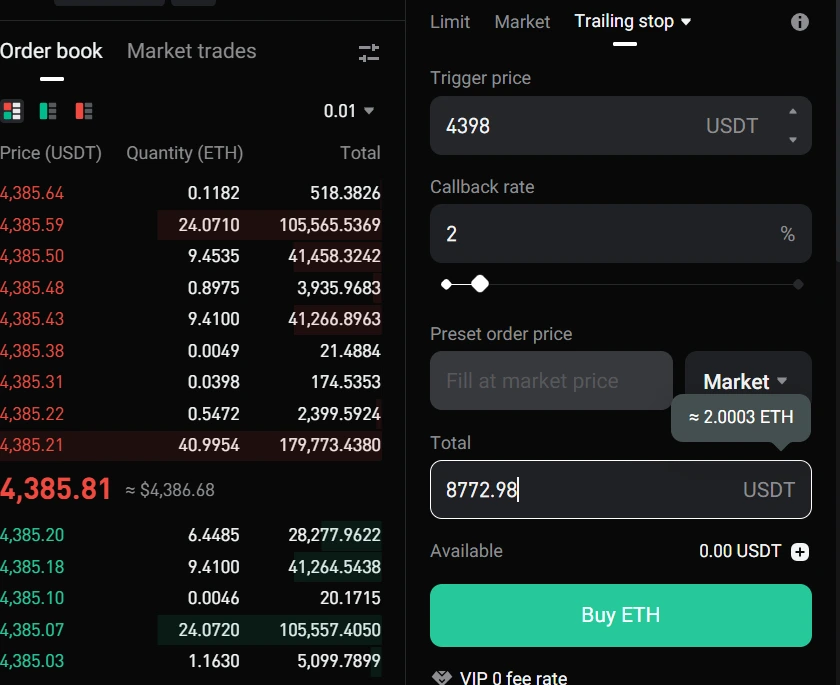

Trailing stop

A trailing stop is similar to a stop loss, but it works in a smarter way. Most people use it to sell automatically when the price starts dropping.

For example, if USDT is 100, you set a trigger price and a callback rate. The callback rate is a percentage you choose.

When the price rises, the system tracks its highest price. If the price starts falling, the system sells based on your trailing stop.

For instance, if the price goes up to 150 and then starts dropping to 140, the system monitors the drop. If you set a 10% callback rate, the system will sell when the price reaches 135.

STO & TSTO Orders

Some crypto exchanges use the names STO and TSTO, but they are not new types of orders. These are just different names for the orders we already know.

STO is another name for a Stop Limit Order. If you know stop limit, you know STO.

TSTO is just a Trailing Stop Order. It works the same way as a trailing stop.

Quick recap:

➡ STO → Stop Limit

➡ TSTO → Trailing Stop

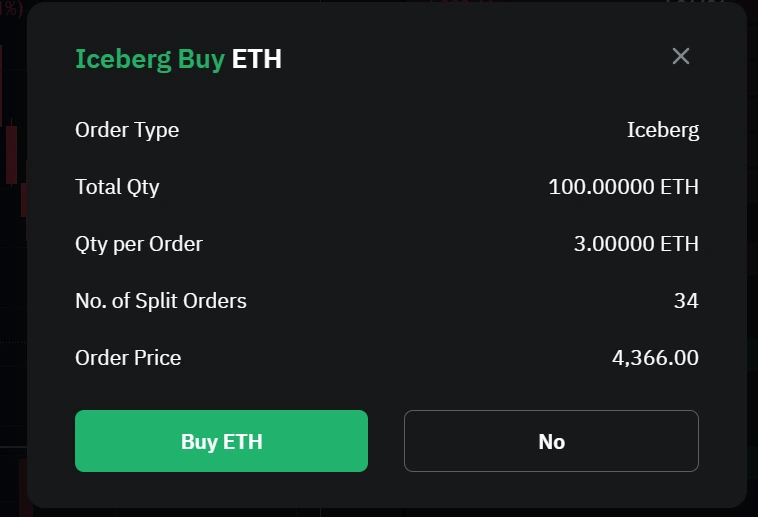

Iceberg Order

An Iceberg Order lets you hide a big trade by breaking it into smaller pieces. For example, if you want to buy 10 BTC at once, the seller might raise the price. The market could also become unstable.

With an Iceberg Order, you can split your 10 BTC into smaller parts, like 1 BTC each. You place each part separately and can set a limit price for each one.

When the price reaches your order, it will buy automatically. This way, your big trade stays hidden and the market stays calm. Iceberg Orders make big trades safer and easier.

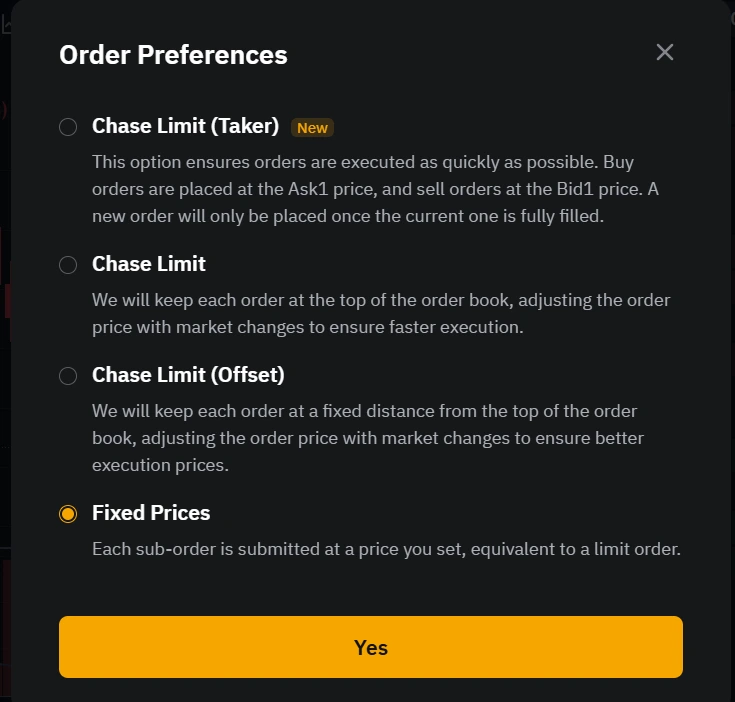

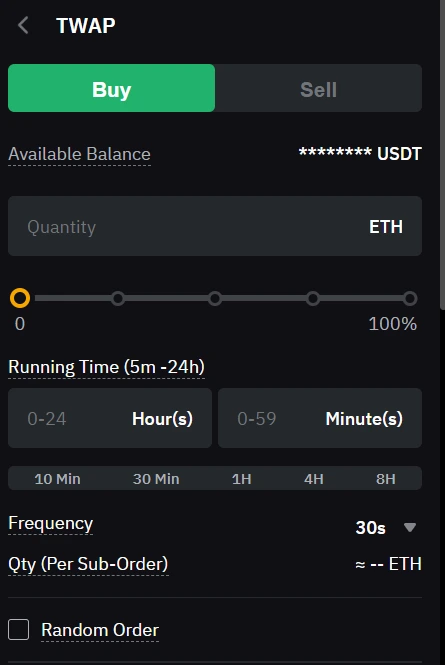

TWAP (Time Weighted Average Price)

TWAP divides a large trade into smaller orders over time. Example: You want to buy 1 BTC in one hour. The system buys small amounts every 10 seconds.

By the end of one hour, you own 1 BTC, but at an average balanced price. This avoids a sudden impact on the market compared to buying all at once.

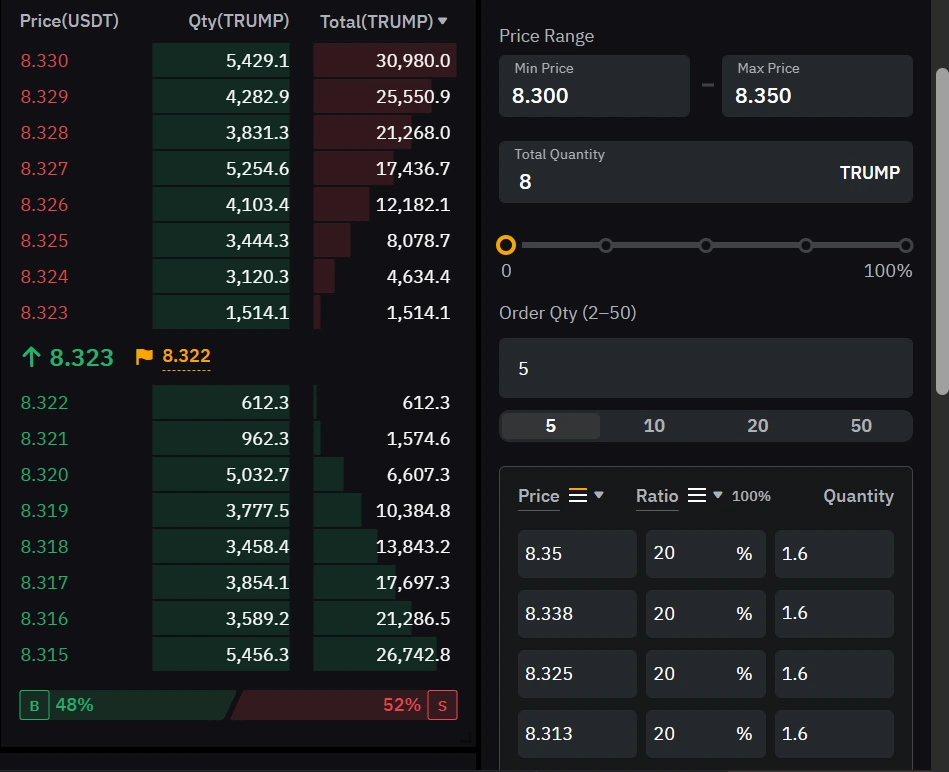

Scaled Order

Scaled order is similar to an iceberg, but here, nothing is hidden. Instead, you split your total order into small trades placed across a price range. This helps you buy or sell smoothly without moving the market too much.

Example:

- You want to buy 100 USDT.

- Current price = $1 per USDT.

- Instead of buying all 100 at once, you set a scaled buy range between $0.70 and $0.90.

- You choose to split into 5 equal orders.

Orders placed:

- Buy 20 USDT @ $0.70 = $14

- Buy 20 USDT @ $0.75 = $15

- Buy 20 USDT @ $0.80 = $16

- Buy 20 USDT @ $0.85 = $17

- Buy 20 USDT @ $0.90 = $18

Total = 100 USDT bought, $80 spent on average price ≈ $0.80 per USDT.

If you are interested in starting your own crypto exchange, you can try our crypto derivatives exchange development solutions.

Why Advanced Order Types Matter in Crypto Exchanges

Advanced order types help traders control their trades better. Instead of just buying or selling at the market price, they can set rules to take profit, stop loss, or split big trades.

These orders also make trading safer. With options like stop-limit, OCO, and iceberg orders, traders can plan ahead, avoid mistakes, and trade with more confidence in the crypto market.

Final Thoughts

We have covered all the order types like spot, margin, and futures. But listen… this is only the start. In the coming time, more advanced trading methods will come. We will also explore them together.

Now think about this… every order type has its own special feature. So before you start trading or plan to build a crypto exchange, you must study them properly. Why? Because this simple step can help you reduce loss and increase profit.

And here is the main point… people are always searching for new ways. If you are not offering them something fresh, they will quickly choose another option. That is why staying updated is very important for growing your crypto exchange.

Want to know more? Just contact us, book a meeting with our CEO, and get clear details about features, ideas, and cost.