When we want to open a shop, we think about many things.

We check the season, the location, and the people nearby. Right?

For others, it may look like just a shop. But for us, it is a business. And business needs proper planning.

Every business takes time and effort. We look at many points before starting.

One smart idea is to choose a business from a fast-growing industry. That way, chances of success are higher.

All industries are changing, but fintech is growing very fast.

Nowadays, everything is digital. People use fintech tools daily. Most people have smartphones, and they use them for payments, banking, and shopping. It is hard to find someone without a smartphone now.

Fintech is full of chances. But only a few areas are ready for strong investment.

Many investors are already watching fintech closely. If you want to invest smartly in 2026, this is the right time to learn where the money is going.

In this guide, we will talk about the fintech areas every smart investor should watch in 2026. We will also learn what makes the fintech sector good for investment and how to choose the right one.

Let’s begin.

What Makes a Fintech Sector ‘Investment-Friendly’?

Before investing in any fintech business, it’s important to understand what makes it a good investment. A strong fintech sector is not just about building an app. It should solve a real problem in a faster and better way than old financial systems.

Let’s keep it simple.

A fintech sector becomes investment-friendly when it has three main things:

- People must need it. If there is no real use, the product will not grow. It should solve a common problem that people face.

- It should scale easily. The business must reach more users without spending too much. Growth should be smooth and cost-effective.

- It must follow rules. Finance is a sensitive field. So the business should be ready to follow all regulations properly.

If these three things are in place, the fintech sector becomes strong for investment. And that’s what smart investors look for.

7 Fintech Areas Every Smart Investor Should Watch in 2026

1. Blockchain and Cryptocurrency

Blockchain is the first and most important technology in the fintech space. It works behind the scenes and keeps everything safe. That’s why it plays a major role in this industry.

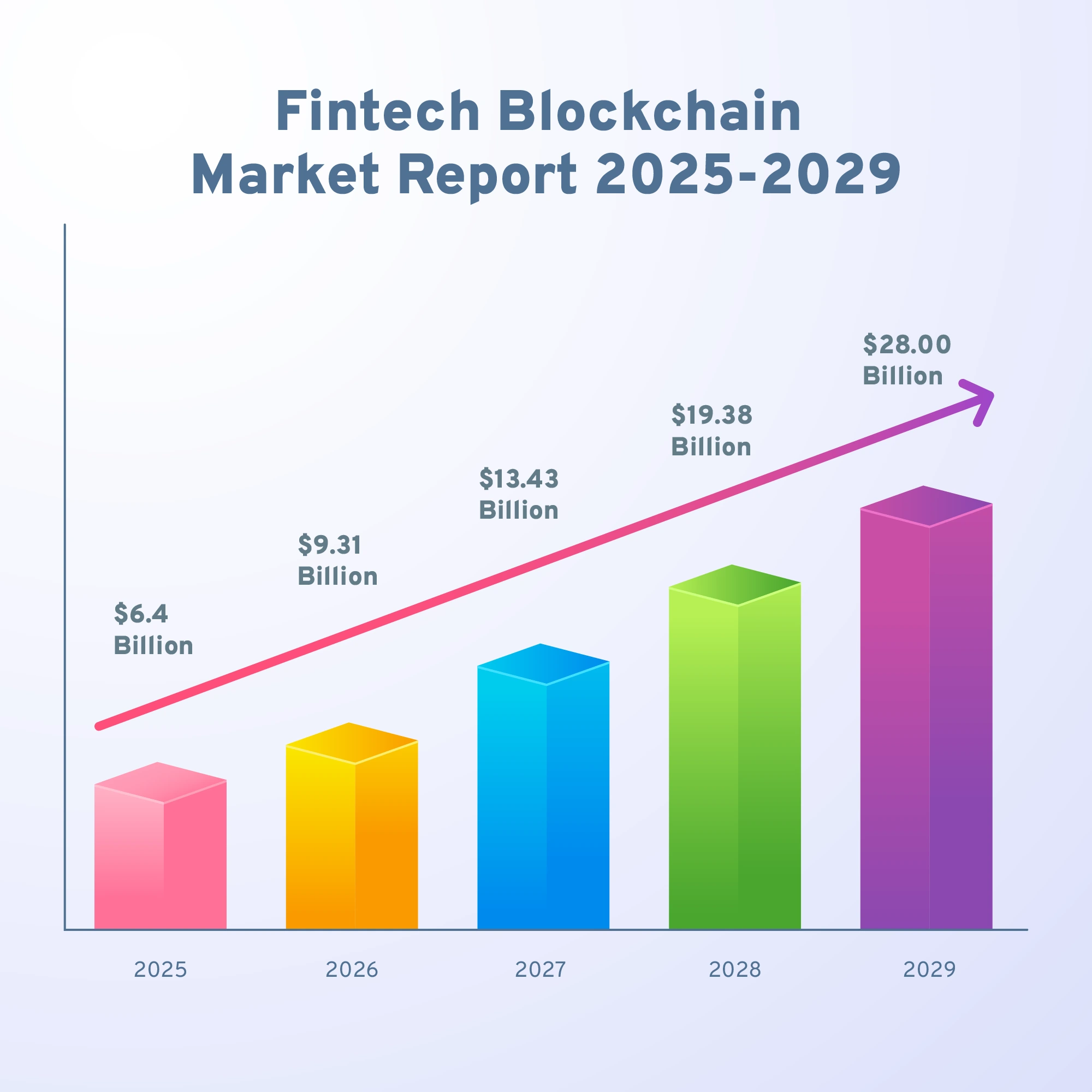

Here’s something interesting. By 2029, the fintech blockchain market is expected to grow to USD 28.67 billion with an annual growth rate of 45% CAGR, as per Business Research Company. This is a massive jump for the blockchain industry.

And that’s just the fintech side. If we include other sectors also, the total value may go above USD 393.45 billion by 2030, with a growth rate of around 64.2% CAGR, according to MarketsandMarkets.

Many banks and even governments are using blockchain for payments and record-keeping. This shows that blockchain is becoming a trusted system in finance.

For investors, this is a strong signal. As digital currencies grow and more companies adopt blockchain, the demand for blockchain-based fintech will keep increasing.

2. Digital Payments

You already know how quickly digital payments are growing. These days, people use UPI, mobile wallets, or QR codes to pay for almost everything.

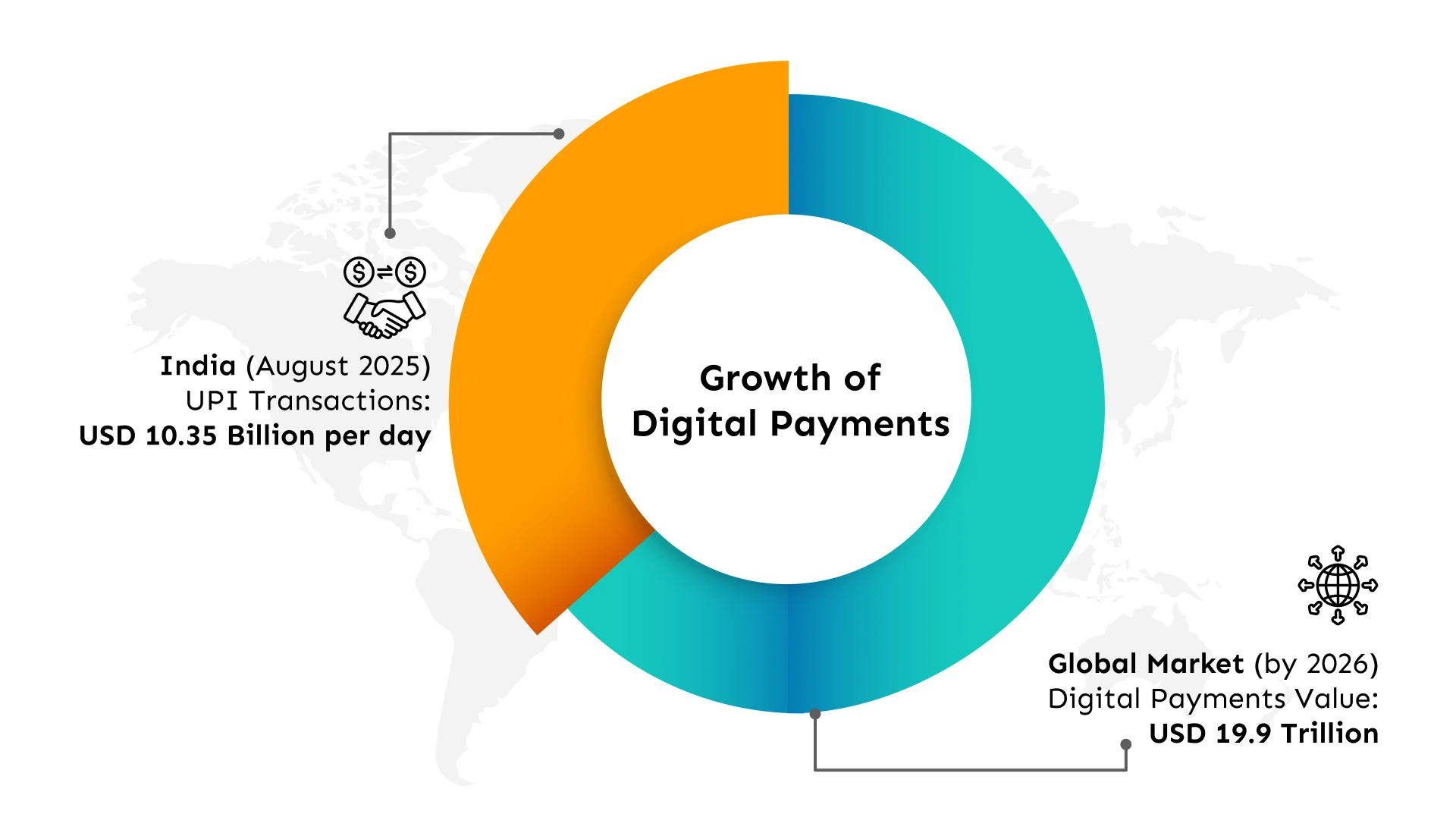

According to IBEF, in India alone, UPI payments reached USD 10.35 billion per day in August 2025. That is a huge number.

Globally, the digital payments market is expected to reach USD 19.9 trillion by 2026.

But it will not stop there. In 2026, you will start seeing new ways to pay, like using face scan, fingerprint, or AI-based systems.

Now, let us see why this is important for investors.

The world is slowly moving towards a cashless system. Every new payment method that saves time and gives more safety will get more users. And when more people use it, the business grows faster.

3. Insurtech

Insurance was once seen as a slow and boring industry. But now, InsurTech has changed everything. With data and AI, companies can offer instant policies and quick claim settlements.

Let’s think about it. After the global health crisis, more people are looking for insurance. And when insurance goes digital, it becomes easy to buy and manage. This means new InsurTech companies have a huge chance to grow. For investors, this sector brings both stability and innovation.

4. Peer-to-Peer Lending

Peer-to-peer lending connects borrowers and lenders directly. It removes banks from the middle. So, borrowers get faster loans, and lenders get better returns.

You might have seen how small business owners now prefer digital loans. P2P platforms make it easy for them to get money quickly. That’s why investors are showing more interest in this space. As more people look for easy credit, this sector will keep growing in 2026.

Here’s something to note. The P2P lending market was valued at USD 176 billion, and by 2034, it is expected to reach around USD 1,380 billion, as per Precedence Research. Between 2025 and 2034, this market is expected to grow at one of the fastest rates.

5. Regtech

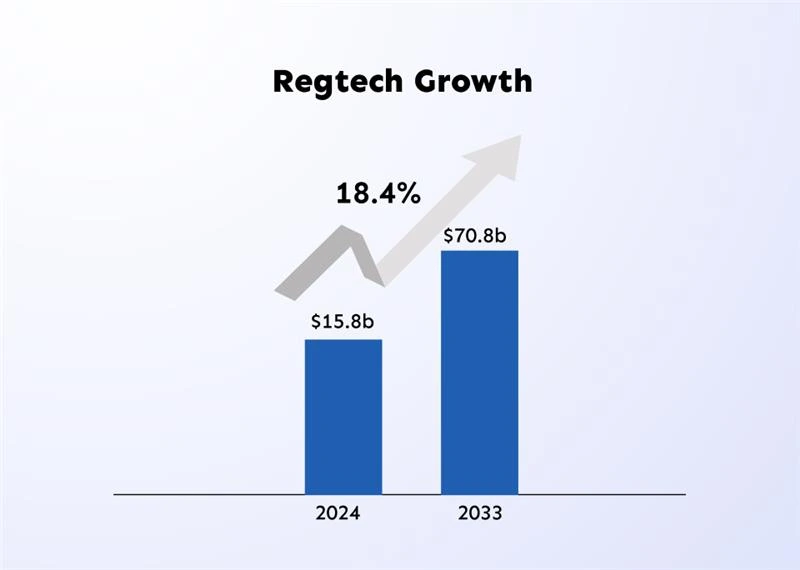

RegTech stands for Regulatory Technology. It helps banks and fintech companies follow government rules using software and automation. You might think this sounds complex, but it’s actually a big money-saver for companies.

Here’s the point. Financial rules keep changing, and companies spend a lot to follow them. RegTech solutions make this process faster and affordable. So, it’s a growing market that will see more adoption soon. Investors who enter early can benefit well.

6. Artificial Intelligence and Machine Learning

AI and Machine Learning are now the brains behind fintech innovation. From fraud detection to giving personalized advice, they handle many things in a smart way.

As per Global News Wire, the global AI in fintech market alone is expected to reach USD 76.2 billion by 2033, with a CAGR of 20.5% from 2025 to 2033.

Now you may ask, why is this important for investors?

Fintech startups that use AI can grow faster and serve more users at a lower cost. In 2026, more companies will start using AI to understand user behavior and manage risks. This is one of the most promising areas for stable and long-term investment.

7. Neobanks

Neobanks are digital banks. They don’t have any physical branches. Everything happens through mobile apps. People like them because they are simple, fast, and easy to use.

Now think about this. Young people today prefer doing everything online. Traditional banks are still trying to catch up, but neobanks are already ahead. They run with low costs and can grow in many countries without opening branches. That’s why investors see neobanks as one of the strongest fintech models for the coming years.

Here’s one more reason to choose a neobank business. From 2024 to 2025, the number of people using neobanks increased by 16% in just one year. In 2024, there were 301.7 million users, and in 2025, it reached 350 million.

8. Digital Share Brokers

Online trading platforms are growing fast. People now buy and sell stocks, mutual funds, and even crypto using mobile apps.

Digital share brokers are making investing easy for everyone. They offer features like zero commission and AI-based suggestions. With more young investors joining the market, this sector will continue to grow. For investors in fintech, this space gives high engagement and recurring income.

Why 2026 Could Be a Big Year for Fintech Investments?

Now you may ask, why focus on 2026? Let’s understand it clearly.

In 2026, two important things will come together. One is technology, and the other is trust. These days, people are more comfortable using online finance. They pay bills, transfer money, and even take loans through mobile apps.

At the same time, governments are making better digital rules to keep everything safe and clear. Investors are also slowly moving away from traditional banks and showing more interest in fintech companies.

Countries like India, Indonesia, and Brazil are growing their digital finance markets very fast. This global push will make 2026 one of the best years for fintech growth. So, it is a good time for investors to explore and enter this space.

How to Identify the Right Fintech Sector to Invest In?

Finding the right fintech sector is just like choosing the right seed to plant. You have to check a few things before you start.

First, see if there is real demand. Is the product actually solving a problem for people or businesses? If it is not helping anyone, it will be difficult to grow.

Second, look at how easily the product can grow. A product that can scale fast usually does much better in the market.

Third, check the competition. If too many companies are already doing the same thing, it might be tough to grow quickly.

Keep these points in mind, and you will be able to pick the right sector with confidence.

Final Thoughts

Let’s be honest, fintech is changing the way we handle money every single day. It’s not just a small part of finance anymore. Today, it’s changing how people send money, save, borrow, and even invest.

Every time someone makes a UPI payment, uses a digital wallet, or opens an online bank app, that’s fintech in action.

The fintech revolution is already happening all around us. If you are thinking about being a part of it, you just need an innovative fintech software development company that can turn your business idea into reality.

Hashcodex can deliver exactly what you expect. Whether it’s payments, lending, or investing, just share your idea, and we will build the software that makes it happen.